33. Flash Crash Example

import numpy as np # linear algebra

import pandas as pd # data processing, CSV file I/O (e.g. pd.read_csv)

btc=pd.read_csv("../input/bitstampUSD_1-min_data_2012-01-01_to_2018-11-11.csv") #importing csv file

btc.head()

Cleanup the data¶

btc = btc.dropna() # remove NaN they do not help

btc["Timestamp"]=pd.to_datetime(btc["Timestamp"],unit="s")

hour=btc["Timestamp"]==btc["Timestamp"].dt.floor("H") # there are over 3 million entries in the dataframe

df=btc[hour] # to make the dataset more simple i only take daily values

df = df[(df['Timestamp'] > '2017-06-20 00:00:00') & (df['Timestamp'] <= '2017-07-23 00:00:00')]

df.head()

Calculate $\Delta$T¶

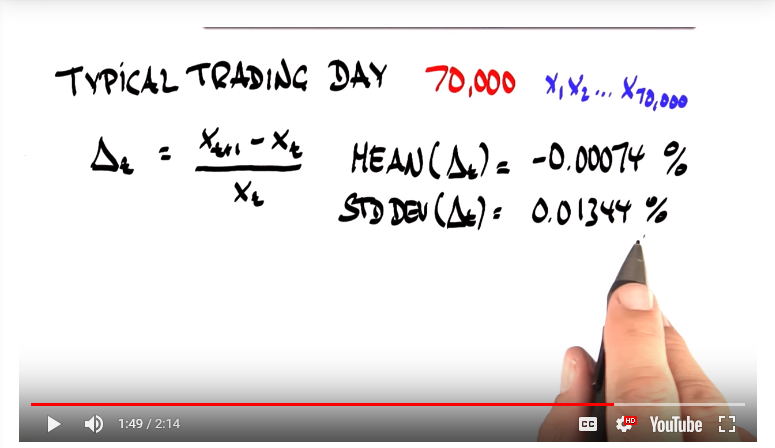

Each $\Delta_t$ at"t"th moment can be defined as b

$$ \Delta_t = \dfrac{X_{t+1} - X_t }{X_t} $$

df['dX'] = (df['Weighted_Price'].shift(-1) - df['Weighted_Price'])/df['Weighted_Price'].shift(-1)

df['dX'] = df['dX'].shift(1)

# df['dX'] = df['dX'].round(5) # rounding to 3 decimal places for better frequency distribution later

df = df.dropna()

df.head()

Plot¶

import matplotlib.pyplot as plt

fig,axr = plt.subplots(2,1,figsize=(14,5))

T = df.Timestamp

X = df.Weighted_Price

dX = df.dX

ax = axr[0]

ax.plot(T,X , color="green", label="BTC/USD") # line plot for seeing the daily weighted price

ax.set_xlabel ("Time")

ax.set_ylabel("USD")

ax = axr[1]

ax.plot(T,dX , color="green", label="BTC/USD") # line plot for seeing the delta

ax.set_xlabel ("Time")

ax.set_ylabel("USD_Normalized_Delta")

plt.legend()

plt.show()

Sampling Distribution of Delta X¶

Let us analyze that, how it looks like to get an idea. Note, this frequency is for a particular time window. If window changes, these could change.

# freq = df['dX'].value_counts()

X = df['dX'].tolist()

fig, ax = plt.subplots(1,1, figsize=(7,5))

ax.hist(X, bins=50)

from matplotlib.ticker import FormatStrFormatter

ax.xaxis.set_major_formatter(FormatStrFormatter('%.4f'))

plt.show()

Strange. The delta differences follow a normal distribution. With the mean almost zero. Let us calculate the $\overline{x}$ and $s$ precisely.

mean = sum(X)/len(X)

var = sum([ (i - mean)**2 for i in X ])/len(X)

from math import sqrt

sd = sqrt(var)

meanstr = str.format('{0:.6f}', mean) # this is a string to print in desired decimal places

sdstr = str.format('{0:.6f}', sd)

print(meanstr, sdstr)

Note, the values we got are similar (not equal though ofcourse) to what Sebastian writes (Psst! that is in percentage)

Thus, we are not only convinced of the values, but also that, we see, the normalized delta forming a normal distribution, we are convinced of taking confidence intervals which should hold good because the given distribution is already normal. Let us take CI for our own values, like how Sebastian does and observe the outcome.

$$ \overline{x} = 0.000042 \ \ \ \ s = 0.009951 \ \ \ \ n = 1 \\ CI = \overline{x} \pm 1.96\dfrac{s}{\sqrt{n}} = ? $$

n = 1 # because each sample set size is 1

l_ci, h_ci = mean - 1.96*(sd/sqrt(n)), mean + 1.96*(sd/sqrt(n))

round(l_ci,4), round(h_ci,4)

Quiz: Outlier Frequency¶

For how many cases will we expect out measurement to fall outside the interval?

from IPython.display import HTML

html = '<iframe width="418" height="235" src="https://www.youtube.com/embed/xku0dnLWkcI" frameborder="0" allow="accelerometer; autoplay; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>'

HTML(html)

This depends on our window. Our total sample sets could be counted, and as per confidence interval, about 5% of them are expected to fall outside the range.

total_samples = len(X)

n_outliers = total_samples*0.05 # about 5% are expected to fall outside as per the distribution we saw earlier

print(total_samples, n_outliers, (n_outliers/total_samples)*100)

Thus out of 787 samples, we could expect about 40 samples to fall outside the range of CI in our given window.

New Interval¶

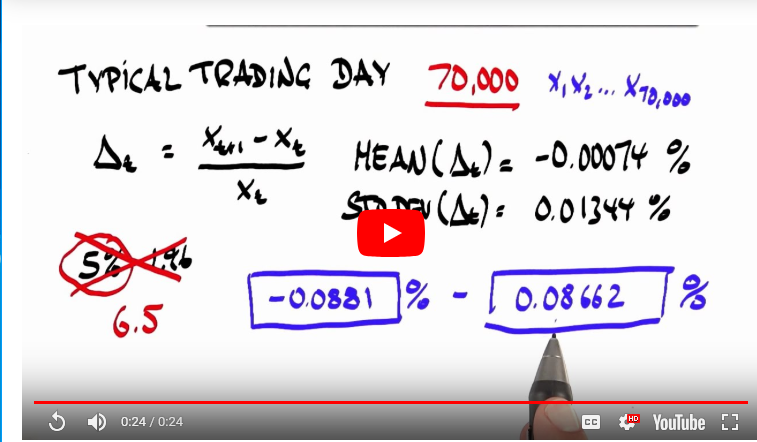

Now Sebastian takes the game to a new (significance) level. This time, instead of z = 1.96, we take z = 6.5, as you can see in normal distribution this is really a rare case.

$$ \overline{x} = 0.000042 \ \ \ \ s = 0.009951 \ \ \ \ n = 1 \\ CI = \overline{x} \pm 6.5\dfrac{s}{\sqrt{n}} = ? $$

n = 1 # because each sample set size is 1

l_ci, h_ci = mean - 6.5*(sd/sqrt(n)), mean + 6.5*(sd/sqrt(n))

round(l_ci,4), round(h_ci,4)

This is also similar to values Sebastian got

Basic Indicator¶

Now that we have the lower and upper limits, let us try constructing a simple indicator. If the delta is out of the lower range of CI, we will raise an alarm (to sell). Since our chosen window is not having a dramatic crash as Sebastian used, we shall use our previous outliers of 5% (that is 1.96).

df['dI'] = 0

# df.loc[df['dX'] > 0.0195, 'dI'] = 1 # using 5% significance as we do not have much of crash in our chosen window

df.loc[df['dX'] < -0.0195, 'dI'] = 1

df.head()

fig,axr = plt.subplots(3,1,figsize=(14,5))

T = df.Timestamp

X = df.Weighted_Price

dX = df.dX

dI = df.dI

ax = axr[0]

ax.plot(T,X , color="green", label="BTC/USD") # line plot for seeing the daily weighted price

ax.set_xlabel ("Time")

ax.set_ylabel("USD")

ax = axr[1]

ax.plot(T,dX , color="green", label="BTC/USD") # line plot for seeing the delta

ax.set_xlabel ("Time")

ax.set_ylabel("USD_Normalized_Delta")

ax = axr[2]

ax.plot(T,dI , color="green", label="BTC/USD") # line plot for seeing the delta

ax.set_xlabel ("Time")

ax.set_ylabel("Indicator")

plt.legend()

plt.show()

Depending on the crash level, one could choose the confidence level, and thus wider range. For eg, 1.96 gives many alarms as above, which may be useful to some, but others may prefer a wider interval to only indicate a bigger crash. They could simply choose a higher confidence level.